Customs Law: Presidential Edition

Next week we in the U.S. will have a new president-elect. Getting there has been an unusually disheartening referendum on the mood and direction of the country. Voting always matters, but it might matter more this year than in a very long time.

With that, we take a quick look at Von Stade v. Arthur, 28 F. Cas. 1274 (S.D.N.Y. 1876)(I cannot find a fee link). Here is the decision in its entirety:

Why is this my "Presidential Edition?" This is why:

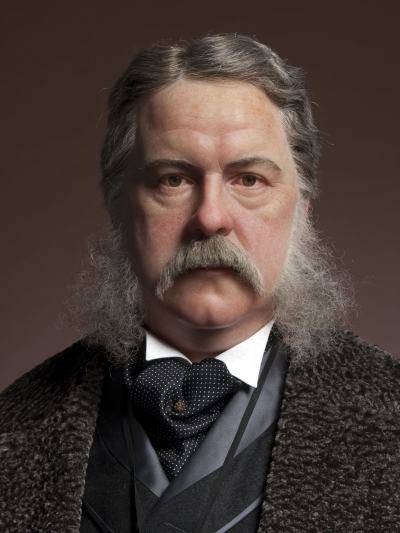

The defendant in this case is the Collector of Customs in New York, a man known as Chester A. Arthur. President Grant had given Republican New York Congressman Roscoe Conkling authority to dole out the federal patronage jobs in New York. The Collector was the plum appointment. In that position, Arthur was able to hire hundreds of customs officers to collect duties at the then-busiest port in the country. The Collector earned as much as any federal official at the time including a portion of the value of seized property and penalties assessed. That created an incentive to find real or imagined violations. Eventually, this stopped and Customs employees became members of a professional civil service with regular salaries.

Arthur continued to rise through Republican ranks. He eventually became the leader of the party in New York and then Vice President to James Garfield. Things did not go well for Garfield.

Thus, the Collector of Customs becomes President of the United States.

With that, we take a quick look at Von Stade v. Arthur, 28 F. Cas. 1274 (S.D.N.Y. 1876)(I cannot find a fee link). Here is the decision in its entirety:

SHIPMAN, District Judge. The second section of the act of June 6, 1872 (17 Stat. 231), provided, that, on and after August 1st, 1872, the existing duties upon the articles which are enumerated in the section should be reduced ten per centum. The section specifies, among the enumerated articles, "all wools, hair of the alpaca goat, and other animals, and all manufactures wholly or in part of wool, or hair of the alpaca and other like animals, except as hereinafter provided." The question in this case is, whether the duty of fifteen cents per pound upon hogs' bristles was reduced by virtue of the act which has been cited.

Waiving the question, whether it was the intention of congress to reduce the duty upon the hair of all animals, whether such hair was used or not in the manufacture of textile fabrics, I am of opinion, that, in the tariff acts, the article of bristles is separately classified, and is regarded as a different article from hair. This will appear from the act of June 30, 1864 (13 Stat. 212), which prescribes a duty upon bristles of fifteen cents per pound, and upon hogs' hair of one cent per pound. The language of the Revised Statutes of 1874 (page 480) is "Bristles, fifteen cents per pound;" "hair of hogs, one cent per pound." The term "bristles" is used in the tariff acts to denote a separate and distinct article from hair, and the bristles are not included in the general words "the hair of an animal," but have a distinct classification.

The issue here is whether a bill reducing the duty on certain animal hair applies to hog bristles? My initial thought was, are bristles hair? It turns out that they are, but that they are a unique variety of short, stiff hair. Most important to the decision is that the Tariff Act of 1864 had a separate and more specific paragraph covering bristles. By this early application of the rule of relative specificity, the Court upheld the higher duty collected by Customs.

Let judgment be entered for the defendant.

Why is this my "Presidential Edition?" This is why:

The defendant in this case is the Collector of Customs in New York, a man known as Chester A. Arthur. President Grant had given Republican New York Congressman Roscoe Conkling authority to dole out the federal patronage jobs in New York. The Collector was the plum appointment. In that position, Arthur was able to hire hundreds of customs officers to collect duties at the then-busiest port in the country. The Collector earned as much as any federal official at the time including a portion of the value of seized property and penalties assessed. That created an incentive to find real or imagined violations. Eventually, this stopped and Customs employees became members of a professional civil service with regular salaries.

Arthur continued to rise through Republican ranks. He eventually became the leader of the party in New York and then Vice President to James Garfield. Things did not go well for Garfield.

|

| Garfield, shot by Charles J. Guiteau, collapses as Secretary of State Blaine gestures for help. Engraving from Frank Leslie's Illustrated Newspaper |

Comments