Ruling of the Week 2015.25: No Refund for CPSC Restricted Goods

[UPDATE: I changed the title of this post to more accurately reflect the content, and to not look like an idiot.]

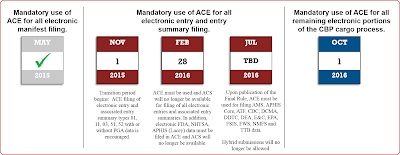

Like a lot of other lawyers who do administrative law, I have lately been thinking about Customs and Border Protection's efforts to wrangle its partner government agencies into using the Automated Commercial Environment to submit data to Customs. If you have been dealing with Customs for the last year or so, you have probably seen this image.

What is happening is the mandatory use of Customs' ACE system for electronic filing of data for other agencies. Previously, this data might have gone to Customs on paper or in a different electronic system. If this works, it will be great. If you are an importer, make sure your broker is up to speed and has invested in the software and training necessary to keep up with these changes.

One of the agencies that is moving toward ACE implementation is the Consumer Products Safety Commission. CPSC regulates and enforces product safety. Products that do not satisfy existing CPSC standards or are shown to be unsafe can be deemed inadmissible. Customs' role is to ensure that importers have the necessary documentation to prove that the products meet any applicable safety standards (e.g., lead content, choking hazards, etc.).

Which brings me to the Ruling of the week: HQ H239257 (Jul. 25, 2013). The importer entered some lighters, which Customs released. However, the CPSC asked Customs to issue a Notice of Redelivery because the importer had failed to file a pre-importation report with CPSC. In this case, the importer actually redelivered the goods to Customs and subsequently exported them to Canada. [Side note to Canada: Be on the lookout for potentially dangerous lighters from America.]

After exporting the goods, the importer asked Customs for a refund of the duties it paid. Note, this is not a drawback claim. The importer just wants its money back and pointed to 19 USC 1558. Under that statute, duties cannot be refunded after the release except for certain circumstances. Relevant to this situation, Customs can refund duties paid "[w]hen prohibited articles have been regularly entered in good faith and are subsequently exported or destroyed pursuant to a law of the United States and under such regulations as the Secretary of the Treasury may prescribe." (I added the emphasis.)

The problem is that when federal agencies interpret their regulations, they sometimes give very specific and technical meanings to terms. Here, the rub is the word "prohibited." The lighters could have been entered into the United States had the importer properly documented them with the CPSC. Consequently, the lighters were not "prohibited," they were merely "restricted." Prohibited merchandise cannot lawfully be imported under any circumstances. Restricted merchandise, on the other hand, can be imported when the importer proves it has satisfied the legal requirements for entry.

Because the lighters could have been imported into the United States if the importer satisfied CPSC requirements, they were merely restricted and not prohibited. As such, CBP refused to refund the duty deposits.

So, when will Section 1558 apply? What is truly prohibited merchandise? Here is CBP's helpful page for travelers. As you might imagine, illegal narcotics and child pornography are both prohibited merchandise. But, it is unlikely that the importer will have declared those goods to Customs and paid duty. Under certain circumstances, Absinthe is prohibited (keep that thujone level down, please) as are unsafe toys and items made of dog and cat fur. There are others including lottery materials from any other country.

One industry that I suspect might qualify for refunds under this provision is the makers and importers of smokers' wares that have been needlessly and cruelly labeled drug paraphernalia [probably NSFW by many standards], which is prohibited merchandise.

Like a lot of other lawyers who do administrative law, I have lately been thinking about Customs and Border Protection's efforts to wrangle its partner government agencies into using the Automated Commercial Environment to submit data to Customs. If you have been dealing with Customs for the last year or so, you have probably seen this image.

One of the agencies that is moving toward ACE implementation is the Consumer Products Safety Commission. CPSC regulates and enforces product safety. Products that do not satisfy existing CPSC standards or are shown to be unsafe can be deemed inadmissible. Customs' role is to ensure that importers have the necessary documentation to prove that the products meet any applicable safety standards (e.g., lead content, choking hazards, etc.).

Which brings me to the Ruling of the week: HQ H239257 (Jul. 25, 2013). The importer entered some lighters, which Customs released. However, the CPSC asked Customs to issue a Notice of Redelivery because the importer had failed to file a pre-importation report with CPSC. In this case, the importer actually redelivered the goods to Customs and subsequently exported them to Canada. [Side note to Canada: Be on the lookout for potentially dangerous lighters from America.]

After exporting the goods, the importer asked Customs for a refund of the duties it paid. Note, this is not a drawback claim. The importer just wants its money back and pointed to 19 USC 1558. Under that statute, duties cannot be refunded after the release except for certain circumstances. Relevant to this situation, Customs can refund duties paid "[w]hen prohibited articles have been regularly entered in good faith and are subsequently exported or destroyed pursuant to a law of the United States and under such regulations as the Secretary of the Treasury may prescribe." (I added the emphasis.)

The problem is that when federal agencies interpret their regulations, they sometimes give very specific and technical meanings to terms. Here, the rub is the word "prohibited." The lighters could have been entered into the United States had the importer properly documented them with the CPSC. Consequently, the lighters were not "prohibited," they were merely "restricted." Prohibited merchandise cannot lawfully be imported under any circumstances. Restricted merchandise, on the other hand, can be imported when the importer proves it has satisfied the legal requirements for entry.

Because the lighters could have been imported into the United States if the importer satisfied CPSC requirements, they were merely restricted and not prohibited. As such, CBP refused to refund the duty deposits.

So, when will Section 1558 apply? What is truly prohibited merchandise? Here is CBP's helpful page for travelers. As you might imagine, illegal narcotics and child pornography are both prohibited merchandise. But, it is unlikely that the importer will have declared those goods to Customs and paid duty. Under certain circumstances, Absinthe is prohibited (keep that thujone level down, please) as are unsafe toys and items made of dog and cat fur. There are others including lottery materials from any other country.

One industry that I suspect might qualify for refunds under this provision is the makers and importers of smokers' wares that have been needlessly and cruelly labeled drug paraphernalia [probably NSFW by many standards], which is prohibited merchandise.

Comments